News release from the City of Fort Wayne:

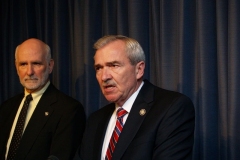

Mayor Henry, Allen County taxing units, and community/neighborhood leaders voice concerns over business personal property tax proposal

Proposal could impact public services and schools and increase taxes

(July 19, 2018) – Leaders from the City of Fort Wayne, City of New Haven, Allen County Public Library, Fort Wayne-Allen County Airport Authority, Fort Wayne Community Schools, East Allen County Schools, Fort Wayne Public Transportation Corp. (Citilink), community leaders, and neighborhood advocates came together today at Fort Wayne Mayor Tom Henry’s office to voice concerns about a proposal that could negatively affect services provided to the public and schools and increase taxes for some homeowners.

For a second time, a resolution has been introduced by members of the Fort Wayne City Council that would eliminate the business personal property tax on new business equipment. Because the majority of Allen County’s population is within the city limits of Fort Wayne, the council resolution would impact all of Allen County. A public hearing on the matter is scheduled for City Council’s meeting on July 24. This plan was originally proposed in 2016 and failed to receive enough votes to pass.

The plan could save select businesses from paying certain taxes, which would shift the tax burden to local governments, schools and homeowners. Taxes collected on business personal property total over $55 million per year countywide to help fund police and fire protection, neighborhood infrastructure improvements, enhancements to parks, and assist school systems to educate children and provide other education initiatives, as well as to provide bus transportation.

Although personal property taxes would be incrementally rolled back under the proposal, the plan provides for no designated mechanism to make up for the loss in revenue. Because of property tax caps, homeowners whose taxes are below 1 percent of assessed value could see a tax increase while also experiencing a reduction in services that those taxes pay for.

Highlights of the projected property tax impact when fully implemented:

- City of Fort Wayne – loss of $17.7 million in annual revenues

- Fort Wayne Community Schools – loss of $11.5 million in annual revenues

- Allen County government – loss of $10.3 million in annual revenues

- Allen County Public Library – loss of $3.9 million in annual revenues

- Southwest Allen County Schools – loss of $3.3 million in annual revenues

- East Allen County Schools – loss of $3 million in annual revenues

- City of New Haven – loss of $1.2 million in annual revenues

- Northwest Allen County Schools – loss of $902,863 in annual revenues

- Fort Wayne-Allen County Airport Authority – loss of $881,846 in annual revenues

- Fort Wayne Public Transportation Corp. (Citilink) – loss of $824,331 in annual revenues

- More than 60 percent of homeowners countywide would see an increase in property taxes because they’ve not reached the property tax cap

“Fort Wayne and northeast Indiana are moving in the right direction with positive momentum and investments like never before,” said Mayor Henry. “We’ve become a destination city and region with quality of life amenities that provide an attractive live, work and play model for individuals and families. Now is not the time to change course and negatively impact public services and schools.”

Leaders today called on the Fort Wayne City Council to vote against the proposal to ensure essential services continue to be provided to residents and children and protect Allen County homeowners from having to pay higher property taxes.