News release from US Senator Richard Lugar:

Lugar: From Cupcakes, to Easter Candy, to Bread;

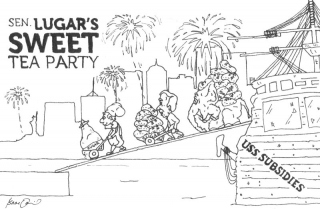

Americans are Being Taxed by Big Government and King Sugar

(March 30, 2011) – Senator Dick Lugar, the former Chairman and most senior Republican on the Senate Agriculture Committee, today once again introduced legislation to repeal the hidden, anti-competitive sugar tax.

“The New Deal-era sugar program has been big government at its worst for decades,” Lugar explained. “It picks the pocket of every American with a hidden tax, drives jobs overseas, and enriches a handful of powerful sugar producers in the United States. It is one of the worst forms of government interventionism in America.”

“Cutting sugar subsidies was among the first votes I took in the Senate in 1977,” Lugar said. “We have made several efforts to further cut wasteful sugar programs and reform the entire Farm Bill. With more Members of Congress willing to take on reform efforts, it is time to finish the job.”

The hidden sugar tax results from a complex government program that subsidizes to a small number of domestic producers of sugar cane and sugar beets. These sweeteners are used in virtually every baked good in America and are widely used in packaged food preparation.

“Every American business that makes candies, ice cream, cookies, bread, or sells lattes, sandwiches, or cupcakes, is paying more than twice the world market price for sugar because of this hidden tax,” Lugar said. “American consumers pay for this tax, while more and more sugar users are being driven out of business because of off-shore producers who don’t have to pay high prices dictated by the U.S. government.”

The “Lugar Free Sugar Act of 2011” would repeal the obtrusive and expensive sugar program to free United States sugar markets from federal government intervention and free American citizens from paying artificially high prices.

“Every time Hoosiers see sugar listed as a food ingredient, they should know that they are paying more than they need to because of the current federal sugar program.” Lugar said. “I still manage my family’s 604-acre farm in Marion County, so I understand the challenges of competing. Yet, I also know that government intervention to keep prices high for a small group of powerful farming interests violates the free market concept of the American economy.”

“Sugar is an essential ingredient in products sold by many Hoosier bakeries, candy-makers, and restaurants and other small businesses. The U.S. sugar program raises their costs of doing business,” Lugar said. “Government policies should encourage economic growth and job creation – the sugar program does the opposite.”

Lugar explained his initiative to repeal the federal sugar program in an essay published today in the Washington Times.

Why it’s time to leave New Deal era sugar policy behind:

1. The sugar program is costly to American consumers, small businesses, and local food production facilities and puts American jobs at risk.

Nationwide, the sugar-intensive food sector directly employs more than a half a million people, according to 2007 Census data. In Indiana, bakeries employ 12,052 people, and another 9,754 with, according to the American Baking Association. Thousands more Hoosiers work in producing foods such as candies, ice creams, drink mixes, packaged foods, and in fresh food services at restaurants and cafes.

A recent study estimated $4 billion annually in economic costs of the sugar program. A 2006 Commerce Department study estimated that every sugar producer job saved, three food industry jobs are lost. Those losses amounted to 111,608 within the sugar-intensive food sector from 1997-2009.

2. The command-and-control sugar program is among the most egregious cases of government intervention in private decision-making.

Current sugar policy substitutes the federal government for the private sector in basic economic decisions about buying and selling, supply and price. Current policy is designed to guarantee that growers and processors of sugar beets and sugarcane receive a minimum price by dictating the amount of sugar they can produce and sell each year. More information on Big Sugar’s sweet government deal is available at [link to 1 pager or website].

3. The sugar program is blatantly anti-trade, thus harming U.S. economic activity and putting foreign food manufacturers at an advantage over the U.S. industry.

Currently, U.S. sugar prices are at or near all-time record highs. The U.S. sugar program raises U.S. sugar prices well above the world sugar price, forcing U.S. consumers, small businesses, and food manufactures to pay more for sugar than their foreign counterparts. On the world market, people pay 34 cents per pound for refined sugar – 20 cents less than Americans pay due to our sugar program. And the 10-year average price through 2009 for refined sugar is 13 cents per pound – less than half the U.S. price.

The Lugar Free Sugar Act of 2011 is supported by a growing number of groups representing wide interests in saving consumers money, supporting job creation, and reducing unnecessary government intervention. Endorsements so far include: Kendallville Kraft facility, Aunt Millie’s, Competitive Enterprise Institute, National Taxpayer’s Union, American Bakers Association, Emergency Committee for American Trade, Everglades Trust, Grocery Manufacturers Association, Independent Bakers Association, International Dairy Foods Association, National Association of Manufacturers, National Confectioners Association, National Foreign Trade Council, Retail Bakers of America, Snack Food Association, Sweetener Users Association, and the U.S. Chamber of Commerce.