![]()

![]()

Press release from the United Way of Allen County:

Free Tax Preparation for Low- and Moderate-Income Residents Starts Tomorrow

Any family earning less than $49,000 annually should think twice about paying someone to prepare their taxes; they may qualify for free tax preparation and the Earned Income Tax Credit (EITC). The EITC can put as much as $5,000 back in some families’ bank accounts and that money can be used to pay for necessities like rent or mortgage.

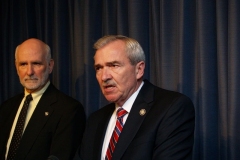

Members of the Financial Stability Partnership, including leaders from United Way of Allen County, the Volunteer Center @ RSVP and Mayor Tom Henry, announced the free tax preparation program today while also demonstrating how the tax preparation process works.

“Because of changes to the tax code in December, there is quite a bit of confusion about whether to file taxes right now,” said Volunteer Center Executive Director Jean Joley. “The changes only apply to individuals and families who itemize deductions, and most people we serve do not itemize. However, we want to encourage everyone to come in now and prepare all the paperwork; we’ll take care of everything by filing the forms when the IRS lets us know they are ready to accept the information.”

The Financial Stability Partnership is reaching out to a new group of residents this year. A VITA (Volunteer Income Tax Assistance) grant secured by United Way will help individuals with disabilities get the transportation and assistance they need to file their taxes and claim the EITC. Anyone with a disability needing assistance should call 2-1-1 to arrange for transportation and other services that will be provided by the League for the Blind and Disabled.

As much as $6 million in tax credits go unclaimed in Allen County annually. Each year, the number of returns filed and people applying for tax credits goes up, thanks to the local EITC effort. In 2010, a total of 4,977 local residents received free tax assistance provided by 125 IRS trained and certified tax volunteers. A total of $2.1 million in refunds was returned to the community, up $400,000 from the previous year.

“One of United Way’s key objectives is to help local residents become self-sufficient,” said Todd Stephenson, president and CEO of United Way of Allen County. “The Free Tax Preparation program helps us do that by assisting low- and moderate-income residents in filing for tax refunds that allow them to pay utility bills, mortgages and more.”To determine if they qualify, residents may pick up an EITC flyer at CANI, United Way, the Volunteer Center, all library branches and many other social service organizations. Or, they can download it from the following websites: www.unitedwayallencounty.org, www.volunteerfortwayne.org, and https://www.aarp.org/money/taxes/aarp_taxaide/. Or, residents may dial 2-1-1 and ask for information from a trained phone counselor.

Free tax preparation is available from January 29 to April 13 at a variety of dates, locations and times. Assistance is available at Community Action of NE Indiana, 227 E. Washington Blvd., on Mondays, Tuesdays and Wednesdays from 6 to 8 p.m. and Saturdays from 9 a.m. to 1 p.m. Or, residents can visit St. Mary’s Church, 1101 S. Lafayette St., Mondays, Tuesdays and Wednesdays from 12 to 3 p.m. Residents can also call the Euell A. Wilson Center at 260.456.2917 and make an appointment for assistance in filing their tax return. Individuals with disabilities may get assistance at the League for the Blind and Disabled; residents should call 2-1-1 to make an appointment. AARP tax preparation sites are attached and are open to any individual. Active Military and National Guard personnel can receive assistance at all of the above sites by appointment by calling 424-3505.

Members of the Financial Stability Partnership include: Volunteer Center @ RSVP, United Way of Allen County, AARP, Community Action of NE Indiana, St. Mary’s Church, Euell A. Wilson Center, The League for the Blind and Disabled, Hispanic Leadership Coalition of Northeast Indiana, PNC Bank, Three Rivers Federal Credit Union, Public Service Credit Union, Wells Fargo Bank, Fifth Third Bank, Purdue Cooperative Extension Service, Internal Revenue Service, American Red Cross – Multicultural Exchange (MIX), Catholic Campaign for Human Dignity, Fire Police City County Federal Credit Union, First Source Bank, Consumer Credit Counseling Service, U.S. Senator Richard G. Lugar’s Northeast Indiana Community Service Center, and the City of Fort Wayne.