![]()

News release from the Henry for Mayor campaign:

Under Mayor Henry, City on track to cut nearly as much debt as Paula Hughes

Hughes plan: raid the Light Lease fund, pay down less debt than Mayor Henry

Paula Hughes has repeatedly stated that, under her plan, the city of Fort Wayne would pay off 24 percent of the debt. Hughes stated that paying off this amount of debt “won’t be easy, but it’s very achievable.” In fact, it has already been achieved.

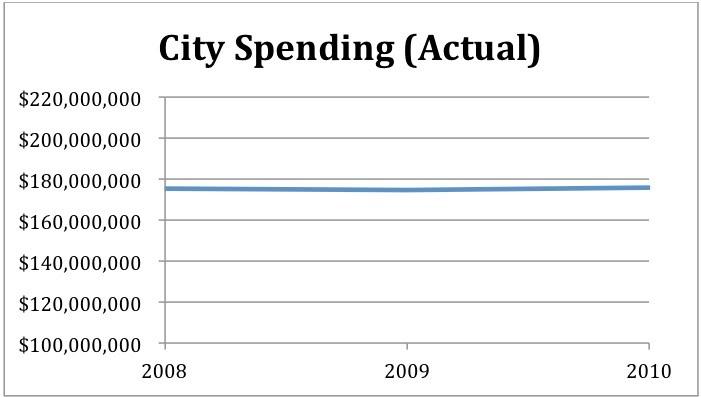

“Mayor Henry has put the city on track to cut nearly twice as much debt as Paula Hughes would,” said Henry’s campaign manager Justin Schall. “And he did it by doing more with less and holding spending flat — not by raiding the Light Lease fund and sacrificing the city’s legacy. Her misguided plan shows she doesn’t understand basic financial concepts — Mayor Henry has put our city on the path to pay down over 40 percent of the debt by 2015, while keeping our finances strong and continuing to deliver quality services to residents.”

What Hughes doesn’t understand is that under Mayor Henry’s leadership, the City of Fort Wayne is on track to pay down $73.77 million – or 41 percent of the debt, by 2015. In other words, Mayor Henry will pay down nearly double the amount of debt as Paula Hughes. Even worse, Hughes would pay down the debt by sacrificing the Light Lease fund — not devoting any of the fund towards job creation and economic development. Mayor Henry has put the city on track to pay down $73.77 million of the city’s debt, while preserving the Light Lease fund for Fort Wayne’s future.

For months Paula Hughes has been misrepresenting the city’s debt situation which has led to her massively overstate city obligations. Now, her most recent release confuses state debt for city debt. If we can’t trust Paula Hughes to understand and be honest about city finances, how could we ever trust her with Fort Wayne’s future?

With her most recent release Paula Hughes is misrepresenting city debt in three ways:

1. Utility Debt- Hughes takes more than $200 million in debt explicitly secured solely by the net revenues of ratepayers and falsely claims it as city debt.

2. State Pension Obligations- In 2009 the 1925 police pension fund and the 1937 firefighters’ pension fund legally became the state’s responsibility. Hughes now claims this $88.8 million liability as the city’s.

3. Accounting Rules as Debt- Compensated absences and other post-employment liabilities are not bonded debt. They are accounting placeholders. Hughes still adds them to her total.

The result is Hughes takes a debt of $176.5 million that is going down and instead claims it’s “over half a billion dollars…” and going up.

The reality is clear. The 2010 CAFR shows that “the city owed lenders…$13.2 million less than 2009.” Going forward, by the end of 2015 the city is on track to reduce debt by an additional $73.7 million, or more than 41%.

City Debt End of 2010 – $176,560,198

End of 2015 – $102,795,000

Difference – $73,765,198 Percentage – 41.78%Attached document for more information about Hughes Misstatements on Debt and detailed documentation.

Stephen – Since you attended the session at 1:30 on Friday and received the position paper from the Hughes group, shouldn’t you, in fairness, also publish it?

John – I have many things going on in my life – more than this blog. Friday was also my birthday, so you’ll forgive me if it wasn’t at the top of my list of things to do.

Stephen – HAPPY, but belated, BIRTHDAY!!!