Â Â Â

![]()

Ben Lanka reported in today’s Journal Gazette that City Council will no longer have an allocation of CEDIT funds to spend in their districts. Â The allocations first totalled $450,000 for each district and $450,000 to be split amongst the three At-Large Council members. Â This year, the amount was slashed to $250,000 with the stipulation that the Council would approve a $30 million CEDIT bond to be issued this first quarter of this year.

During the budget hearings last year, Councilman John Shoaff talked about the financing costs for a $30 million CEDIT bond. Â (Audio of the October 23rd 2008 CEDIT discussion) Â He stated that Controller Pat Roller had told him the costs would be approximately $14 million. Â He said he wasn’t sure if that included the bond issuer fees, or if this was an additional amount. Â He then went on to comment:

Traditionally, I think, bonds were created like mortgages for houses – to finance something that you needed as a whole, up front. Â Here we have quite a long string of projects, which could be prioritized, and if to the extent that it would be possible to phase these in over time, you could pay as you go and save this considerable financing cost. Â So I think every effort should be made to move in a direction of buying and paying for as much as – on a pay as you go basis – as you can, and, after that you worry about floating a bond issue and you try to get the cost down.

CEDIT dollars are paid to the City by the State twice each year. Â My understanding is that there is not a set-in-stone time for the payments to be made, which is part of the problem. Â The City needs to have the money ready to go for the various projects paid for by CEDIT dollars, so to insure the projects stay on time, a bond is issued to give the City the funds uninterrupted. Â But think what the City could do with that $14 million if it didn’t spend it on interest payments for the bond… Â That’s $14 million more in projects that are completed. Â This is a real simplistic explanation and there is a lot more that could be said. Â It’s something I’ve planned for a future post. Â

I was a bit disappointed that Ben didn’t add anything about this to the article as I think the discussions held last year by the City Council surrounding the CEDIT issue could have played into this. Â Perhaps the City is trying to protect this instrument and the infrastructure needs it will address. Â Not so much from a power grab point, but rather to insure that projects keep moving.

Â

[poll id=”38″]

Â

Anyway, from the newspaper:

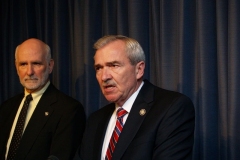

[…] Deputy Mayor Greg Purcell last week said 2009 will be the final year that members of the council get to determine how to allocate a portion of county economic development income tax revenue. Purcell said having all the money in one pot would let the city use it more efficiently.

“The city has financially distressing times ahead of us,” he said. “We need to use dollars in a way to keep projects online.”

[…] “I don’t fault the mayor for this at all, it’s just disappointing,” Council President Tom Smith, R-1st, said about the decision to end the program. “It helped a lot of smaller neighborhood projects that probably won’t get done as quickly or as easily as in the past.”

The change could also be seen as a power grab by Mayor Tom Henry, who will now have more authority in how the money is spent.

While Henry – a 20-year council veteran – has the ultimate say on any council member’s project, the projects are typically approved as submitted. Council incumbents have then often used those projects to tout their effectiveness during re-election campaigns.

[…] Splitting money among the council districts began in the 1990s as a requirement for starting the CEDIT program in Fort Wayne. Council members told then-Mayor Paul Helmke that some money would have to be set aside for each district if he wanted their support.

[…] Mayoral spokesman Rachel Blakeman said the program was not ended because of concern over how council allocated the money but because the state’s new spending caps will limit city revenue.

The latest state estimates project the city will lose $7.6 million in revenue next year and $9.1 million in 2011 because of the caps, which also keep property tax bills steady.

[…] The unspent money didn’t roll over to the city’s general fund but was instead left for each council member to spend in future years. This is why district spending for 2009 varies from $451,726 in the 6th District to $224,272 in the 4th District.

In total, the six district council members have $462,500 left to spend after this year if all listed projects come in on budget.

Smith has stored the largest pot of CEDIT cash, with $213,500 left in his account. He said he likes to save for emergency situations.

[…]Â Other remaining amounts are: $0 in the 2nd District, $2,000 in the 3rd District, $149,500 in the 4th District, $92,000 in the 5th District and $5,500 in the 6th District.

Gina Kostoff, board of works chairwoman, said the remaining money will be left for each council member to spend.

[…]Â Goldner said she is less concerned about council control over money than about the shrinking amount of money available for infrastructure work.

She said she trusts the city to include small neighborhood projects when it spends the money.

Smith said he is glad the city still wants to hear from residents.

He said he hopes the administration works with the council on deciding how to spend any federal stimulus money the city might receive as well as the city’s trust fund, when it becomes available next year.

The trust comes from revenues from the city’s light lease with Indiana Michigan Power and could be spent on anything next spring, or not spent at all.

Smith said if the money was to be used, it would be best spent on infrastructure.

CEDIT is County Economic Development Income Tax – an optional tax levy imposed by the State of Indiana only after a county council requests it. It is collected as an item reported on your Indiana State Gross Income Tax Form IT-40. It is distributed to the county, any incorporated city within the county as well as towns or other political enties in the county based on the ratio of population. For Allen County this involves its unincorporated area plus eight incorporated cities and towns. Fort Wayne is the very largest of these with the planned distribution in 2009 amounting to $23.02 million of the total Allen County distribution of $30.56 million.

An ordinance, S-08-07-28, authorizing the issuance and sale of up to $30 Million in tax-anticipation bonds backed and to be paid with CEDIT revenues remitted to the city by the state in future years received final City Council approval on December 9, 2008. (I do not believe these bonds have yet been issued and sold.)

As Stephen said, Pat Roller told John Shoaff that the cost of borrowing these funds with this bond would be $14 million. And why expend this amount at this time? No answer and really no discussion about it.

The only possible answer is that all of the six categories of projects JUST HAD TO BE DONE RIGHT AWAY! Review these categories and see if this is really the case (listen to the audio of the October 23, 2008 CEDIT discussion that Stephen referenced above).

I believe that our City Common Council can bring this back for another discussion AND can DISAPPROVE this before the bonds are issued and sold – and shouldn’t they do this, based on the financial plight that our administration is concerned about?

And even if council doesn’t do anything, the passed ordinance reads that the bonds were approved “up to $30 million” and isn’t $0 within that???? So, Mayor Henry, how about saving the city $14 Million by just NOT ISSUEING THESE BONDS AT THIS TIME?